Table of Content

This is the first time a broker told me the truth and was not hard selling. When I upgraded my home, Mortgage Master was my first port of call, and their explanations and value-add was a breath of fresh air. Not only have they saved me a considerable sum of money, I have referred friends and family to them and they have never disappointed. Great rates, but more importantly the education by the team on loan details was a strong plus factor. Not everyone is a finance expert, and it was easy and detailed from him.

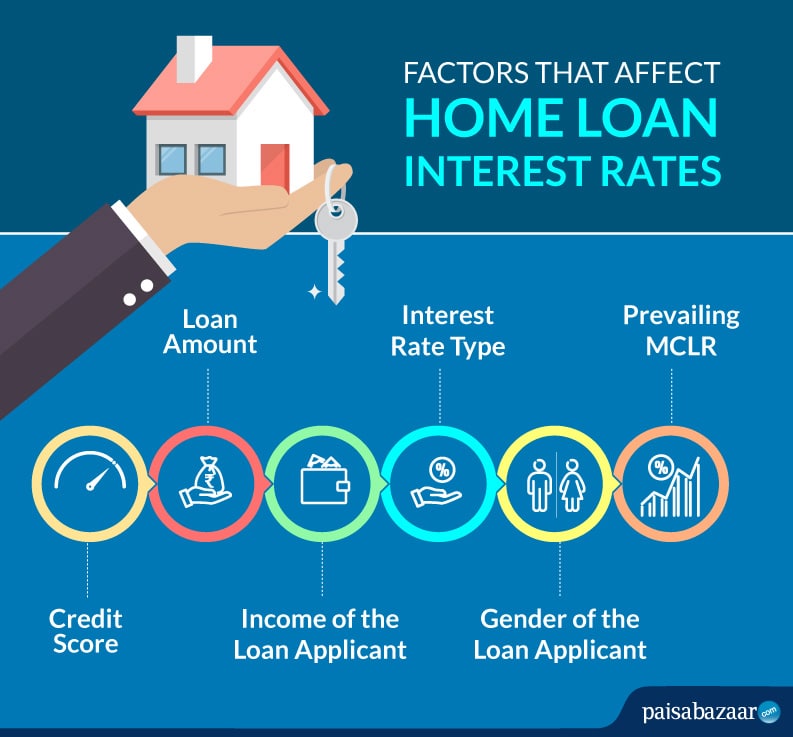

Banks look at a variety of factors when deciding on your loan amount. These include your your income level, credit score, your Total Debt Servicing Ratio , your existing credit facilities, and more. Additionally, get up to S$100 cashback and up to 1% cashback on total loan amount upon loan approval. Enjoy exclusive renovation loan package for home loan customers from 2.88% p.a. More savings with HSBC SmartMortgage which allows you to reduce your interest of home loan by offsetting with the interest earned on your current account. However, there is a penalty fee if you refinance too often, so it is better to avoid doing so unless you have found a considerable lower offer.

Apply for home loan

At Mortgage Master, because of our long-standing relationships with our partners, we also get access to exclusive rates and packages that are not available to the general public. We also partner with reliable bankers and law firms that we entrust our customers to. They ensure that your home loan application process is smooth and efficient. We found that the cheapest fixed rate HDB housing loans are offered by banks listed in the table below, which charge interest rates that are around 15-20% lower than the average for fixed rate home loans.

You get to decide whether your home loan interest rate changes for month to month, or stays the same for years. For example, a more volatile interest rate may start low at first, but can change overnight to a higher interest rate. On the other hand a less volatile interest rate may be relatively high, but you might save money in the long run. Learn more about board rates and why you should be careful when choosing one.

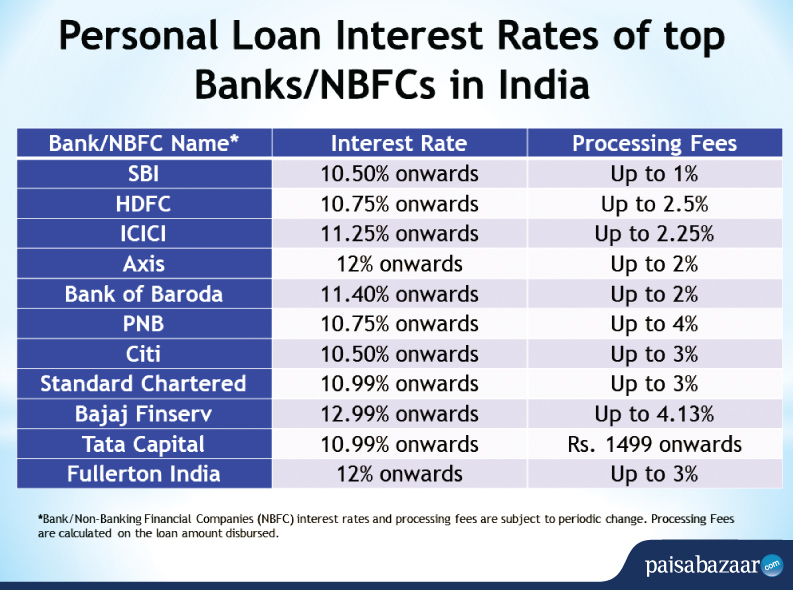

Complete Guide to Personal Loans

Floating interest rates tend to be lower than fixed rates because banks are willing to offer a lower rate for the opportunity to charge you higher rates later. A fixed rate, on the other hand, will guarantee a certain rate for the borrower for a long time, so banks charge a premium for these in low-rate environments. In the table below, we show the difference in average fixed and floating rates for home loans as of January 2020. Our analysis indicates that the cheapest floating rate loans for HDB flats are offered by the lenders below, who typically charge interest rates that are 20-30% cheaper than the average lender. Therefore, choosing one of the cheaper options from the list above can help you save up to S$30,000 on a 25-year, S$500,000 loan.

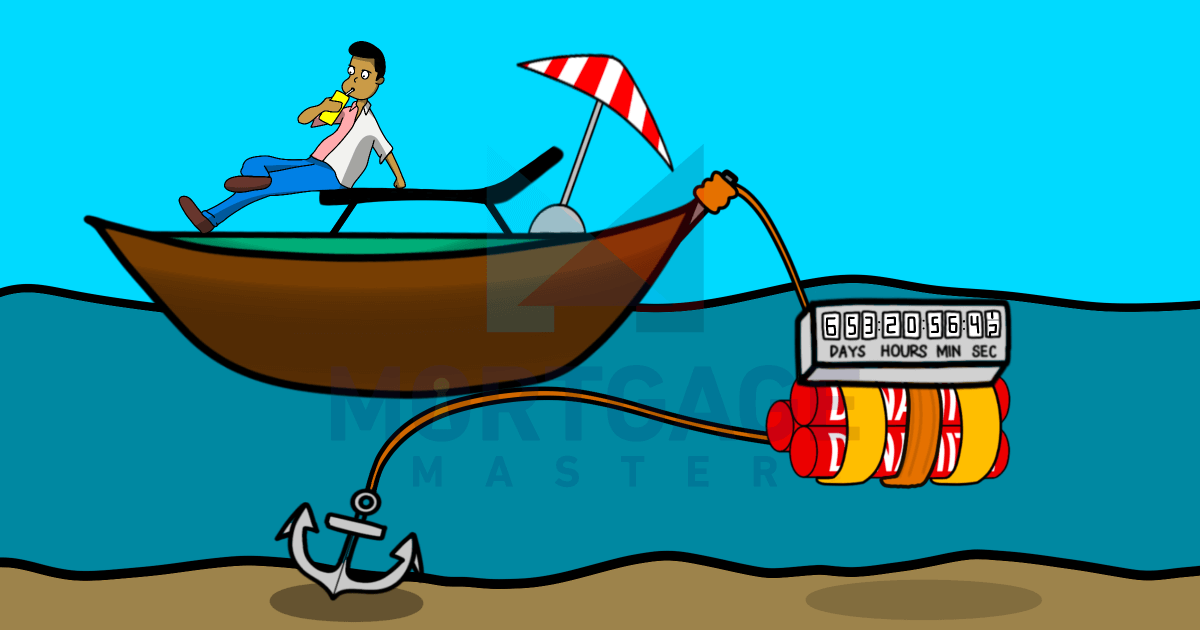

Lock in period – a fixed period; usually 2 to 3 years you are obligated to remain on loan with the bank. SIBOR – Singapore Interbank Offered Rate is determined by the interest rate which banks in Singapore lend unsecured funds to each other at a maturity of 1, 3, 6 or 12 months. Variable rates are typically pegged to a reference rate from an international body or a financial institution’s in-house rate. Responded fast to my queries when reviewing through the loan offer which I really appreciate it, as he helped to make the entire refinancing process very easy.

Will My Credit Score be Affected by Refinancing?

In general when rates are rising , you will benefit more by locking down a fixed rate home loan at early stage of the cycle. The reverse will be true then when rates are falling where floating rate home loans will be favoured. Between the cycles is when the decision becomes tougher and it is here that professional mortgage brokers make the biggest difference in terms of dispensing the right advice. After all this is what they do day in and day out – monitoring macro environments and tracking interest rate movements. In general, floating rate is more suitable for investment property as there is rental income to offset increases in monthly repayment.

Other banks will try to offer better promotions to draw you away from your current bank. If a floating interest rate appears to be stable enough to remain lower than the fixed rate for the next two years, go with that option. If it isn’t stable, stick with the fixed rate for safety. Depending on your circumstances both interest types can be beneficial. You don’t need to worry about the entire length of your loan but only the time of your lock-in period.

The fee depends on how high your interest rates are, as well as how late you are. Mostly, you won’t need to feel rushed with your repayments. The majority of repayment options give you anywhere up to 35 years to pay it back. The shorter term you choose to pay, the less interest you will end up spending.

Below, we discuss the best mortgage loan options available in Singapore for these homes. Below, we show the total interest cost for the top fixed home loans in Singapore. Our chart assumes a 25 year S$500,000 loan for a completed HDB flat.

Board rates are even more intense than that with the potential for great rewards or the opposite. Fixed rates sit at a stagnant level, regardless of the market change. We help you compare the various packages with the most accurate and updated rates, and using a very comprehensive format in our Rates report.Check it out. This fee is also applicable if you sell the property at T.O.P.

Wondering how much HDB, condo, or landed property home loan you can get from the bank? Your maximum loan amount is determined by the loans you currently have – measured by the Total Debt Servicing Ratio or Mortgage Servicing Ratio , which you can calculate with our home mortgage loan calculators. Turn your dream home into reality by purchasing or refinancing your property. Let MoneySmart help you make a better decision by comparing the best home loan interest rates that is suited to your needs.