Table of Content

He always provide answer to my queries promptly and correctly. I am glad to have Garry to help me on the successful mortgage loan.Thanks Garry. I did not make a quick decision when he 1st approached me but he patiently follow up with me on the latest rate.

To handle throughout the whole loan application process and made mortgage loan so EASY. The total repayment is the entire amount that you’ll need to pay off your loan, including interest. Total repayment changes depending on current interest rates. If you mean to pay off your entire loan at once, wait until the interest rates are low. This doesn’t mean you will acquire the first loan you chose, however.

Our Refinancing Resources

For a loan of this size, you should expect to pay somewhere between S$100,000 and S$150,000 in fees and interest. This cost does not include fees for late or early payments, which we typically advise against. Besides the possibility of conversion when the property receives its Temporary Occupation Permit , note that there are loan packages that are not valid for buildings under construction.

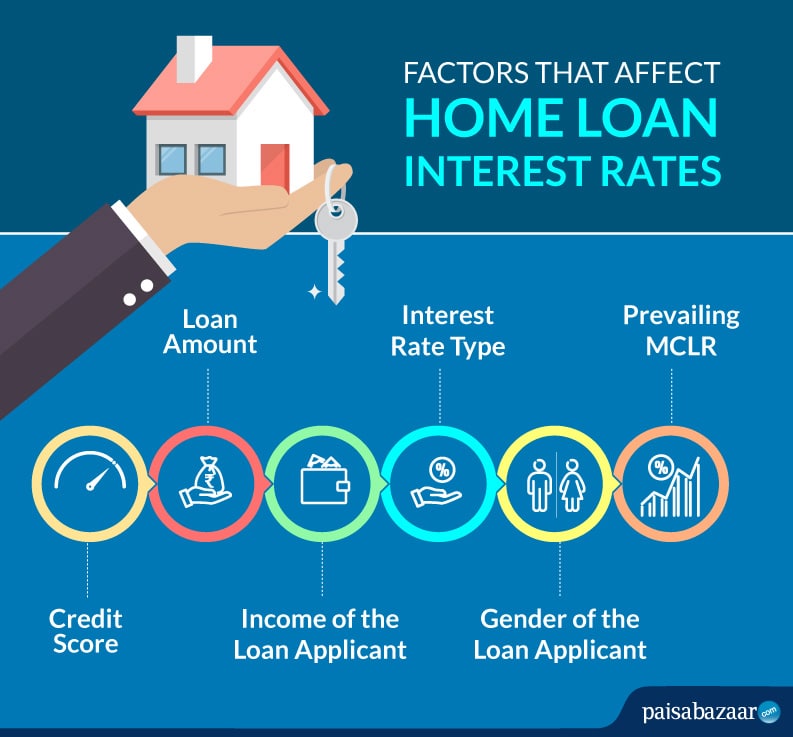

On this basis, we’ve compiled a list of bank loans with no lock-in period and the lowest interest rates. Fixed interest rates are self-explanatory, meaning that the interest rate will be maintained during the entire period of the mortgage agreement. This gives you stability and consistency, making it handy when you plan out your finances every month, since the monthly mortgage repayments are always static at a specific amount. Interest rates are always changing due to the volatile market conditions, but they typically range anywhere from 0.80% to 2.50%. Current bank rates are usually offering about 1% and more, so be sure not to settle for the first bank loan you lay your eyes on. The cost of your mortgage depends on your monthly cost and the total interest cost.

Compare and Get the Best Home Loan

This means that you have to watch out for restrictions and fees like lock-in periods, legal fees, valuation fees and fire insurance premiums, which could eat into your savings in interest. Home loan refinancing can be a great tool for homeowners. In fact, most people in Singapore refinance their mortgage every 2 to 4 years. When refinancing your home loan, banks will often ask about the interest rate you are currently paying on your home loan, and quote you a rate lower than that to win or maintain your business. Therefore, refinancing can help you get lower interest rates and thus reduce your monthly instalments.

Your interest rate will be quite low for the first year or two. After those years expire, your rates will be altered to fit the current overall interest rates. These may be even lower or possibly higher, depending on the market. You can also choose to pay the loan back early if you happen to fall into more money in the future.

What do these home loan terms even mean?

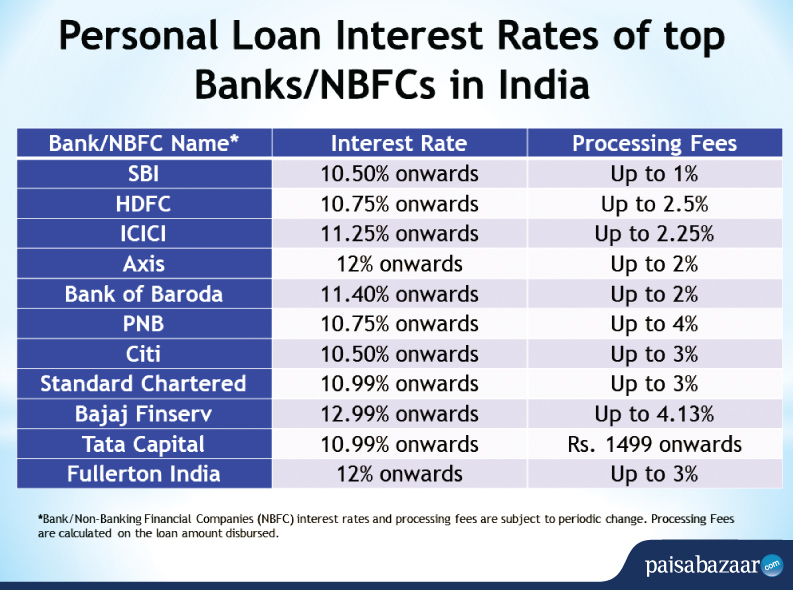

Foreigners in Singapore are also eligible to apply for a personal loan, depending on your salary and employment permit/pass type. Read this article on how tochoose the best personal loans to ease your cash flow. You need to keep up to date and compare available options to learn which is best for you and your current situation. Before refinancing your home loan, make sure you have all the necessary information. This will include things like your current balance, monthly instalments, tenure, fees, and interest rates.

There are 2 main categories, these being fixed rate and floating rate home loans. Board rates are a major subcategory under floating rates. In addition, different rates are offered for both private loans and HDB loans. Here, we zoom into a succinct explanation of and the best rates for each of the different categories so that you can discover the best home loan in Singapore for the category of your choice. If you've browsed through the different banks' mortgage loans, you'll realise there are numerous packages and interest rates you can choose from – and lots of jargons to boot.

If you’re looking for a less volatile package, go for the 3M SIBOR as rates only change every three months, making it less volatile and less risky. In this high-interest home loan climate, choosing the right home loan for you is crucial. Treat it as if you’re buying a new pair of shoes - you have to shop around to find the best pair that fits you, while also making sure they’re at the lowest price possible.

Conversely, we would advise you to go with a short-term rate in a declining to flat-rate environment. Some people are distrustful of them because of a lack of transparency as to the benchmarks used. Additionally, there is no stopping the banks from raising them every now and then based on their own criteria/mood. Read our article on what is the difference between of using a mortgage broker vs bank to understand which would be a better pick for you. Singapore Overnight Rate Average is a newly introduced interest rate benchmark that is based on a volume-weighted average rate of transactions in Singapore between 8am and 6.15pm. To read up more, you can refer to our guide on SORA Rates 2021.

Either way through the broker or direct to the bank, the distribution costs to the bank remains more or less the same. MoneySmart is a one-stop solution when it comes to getting a housing loan. We are able to offer packages from all the banks in Singapore as we are partners with all of them.

At Mortgage Master, we understand that everyone has different risk appetites and also different levels of awareness when it comes to mortgage jargon. Let’s start with a very quick summary of the four types of home loans available in Singapore. With so many types of Personal Loans available, it can get a little confusing. Here's all you need to know about Personal Loans in order to make smarter financial decisions. Get a reward upon home loan acceptance when you apply online Terms and Conditions apply. It is always better to opt for a variable interest package during a falling interest rate environment.

The fixed rate may start somewhere around 4% but it will never go above that mark. This way, you will always know how much you need to save for it, rather than risking it going too high for your budget. You should consider the cost of a home loan in terms of its monthly cost and total interest cost. Keep in mind that your maximum home loan amount will depend on your total amount of loans you currently have. To estimate how much your housing loan will cost, use our free mortgage calculator tool. You can save about S$1,400 annually by switching from an interest rate of 3% to 2.5%.

Try to find a mortgage that leaves you with at least some savings. You need to make sure that your budget fits the mortgage. • The monthly payments must not exceed 28% of your pre-tax income. If you want a different one, you will have to pay a small fee for this as well.

SingSaver's cooperative organisations include Singapore's largest and most credible banks, financial companies, insurance companies and other financial institutions. It provides users with a fair overview of Singapore's financial products. Through our comparison tool, you can compare various credit cards, personal loans, online brokerages, robo-advisors, travel insurance, home insurance, bank accounts, and other financial products. In order to ensure that you can choose the best product, we provide the most accurate and up-to-date information. Instead of a fixed rate loan, you can choose to get a floating rate home loan to finance your HDB flat. Floating rates are pegged to reference rates (e.g. SIBOR, SOR, bank's board rate) that continuously move over time.

Since more volatile interest rates are often the cheapest in the market, they are definitely worth considering when your loan amount is lower. This depends on the salary that you earn, as your borrowing amount is typically a multiple of your monthly salary. A common limit to the loan amount you can borrow is 4x your monthly salary. Some banks also set a maximum amount that can be borrowed, such as a limit of $200,000 regardless of how much you earn.

No comments:

Post a Comment